SEISS – What the support for self employed entails and who is eligible

Self-employment Income Support Scheme

Portal opens 4th May for eligibility and will be fully open on 15th May for applications

UPDATED 4th May 2020

Are you eligible for the Self Employed Income Support Scheme?

Click here to find out (scroll to the green box which says ‘Check now’ about half way down the page)

YOU NEED TO APPLY YOURSELF, YOUR ACCOUNTANT CANNOT DO IT FOR YOU.

PLEASE DO IT NOW, TO GET IN THE SYSTEM. LOOKS LIKE THE MONEY WILL BE AVAILABLE SOONER THAN EXPECTED, BY THE END OF MAY

You don’t need to be a client of ours to share this, or to get in touch. Please email helen@theaccountancypractice.com and we will see if we can help shed some light on your personal position.

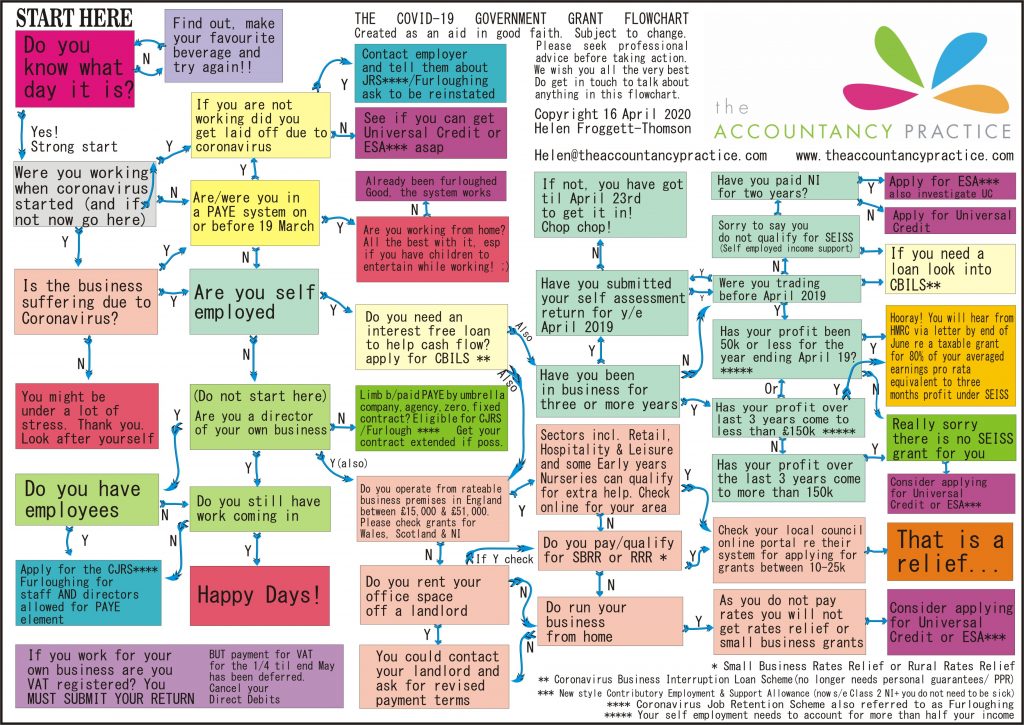

Meanwhile this flowchart we designed might help.

- This new package relates to self employed people or people operating their self employment in partnerships with annual profits under £50,000 a year.

- Please see if you are eligible using the online system here. The grant to be distributed in June, representing three months profit in one lump sum.

What the self employed support entails

In summary, a lump sum to provide support for three months lost trading due to Coronavirus.

- Payment is expected to be in June (but may be before if they get their act together)

- It is the equivalent of 80% of your averaged out ‘usual’ income up to a maximum of £2500 per month.

- You will need to have submitted at least one tax return, for the year ending April 2019.

- If you’ve not submitted your self employment tax return which was due at the latest in January this year, you have been given until 23rd April to get your tax return in, so you can qualify for support from the government.

Who qualifies and what can you get?

There are two caps.

- The grant is up to a maximum of £2500 per month

- This grant is for self employed people with profits up to £50,000 per year.

Keen to make the support similar levels for self employed as PAYE employees, self employed people will be able to be given a TAXABLE lump sum in three months time, to cover March, April and May.

The payment will be 80% of your taxable profit as shown on your last tax return. Divided over twelve months. However if you’ve been trading longer than that, to help people who may have had a varied profit over the last three years, HMRC will use up to the last three years to create an average.

Profit is the figure you come to on your tax return which is the amount, after costs are taken off, on which the tax calculation is based. So in simple terms, your sales income might be £25,000, your costs might be £10,000, your profit is £15,000. Your tax calculation is based on that £15,000. The £15,000 is your profit for these calculations.

Turnover is the amount you earn in total, in sales. For most businesses, there’s a lot of costs to account for when running a business and it’s essential to have these figures to be able to work out what your profit is. Profit is quite simply the difference between the sales and the costs. Some businesses make a loss because their costs are greater than their sales income. Many start ups are in this position as the costs are usually greater when you set your company up. They will unfortunately not receive anything under this scheme.

Let’s see how this would work in practice:

Example 1

- If your profit for year ending ’19 was £10,000, for year ending ’18 was £20,000 and for year ending ’17 was £15,000 your total for 36 months would be £45,000.

- Which would be divided by 36 months to be averaged out at £1,250 per month.

- 80% of that figure will be given to you from the government, as a taxable grant.

- So you won’t have to pay it back, but you’ll have to include the figure in your tax return for the relevant year.

With the above example you would receive £1,000 per month.

And you would need to pay tax at the relevant rate when you submit.

Workings:

10,000 + 20,000 + 15,000 = 45,000

45,000 divided by 36 = 1,250

80% of £1,250 = £1,000.

This would be payable as a lump sum in June (or perhaps a little sooner) of £3,000. March, April and May all at once.

This figure will need to be submitted on your tax returns.

Example 2.

If your profit is significantly higher than the figures we’ve used, you will get more. However. There is a ceiling on the annual profit figures. And your monthly ‘grant’. Which is £50,000 of annual profit and £2,500 per month. So the maximum anyone can get on this scheme, if their profit is £50,000 each year for three years is worked out like this.

Workings:

50,000 x 3 years = £150,000

£150,000 divide by 36 is £4,166 and 80% of that works out at £3332.00 per month.

However, you will only receive £2500 per month from the government for the period of three months of which this is the first month. So a maximum payout of £7500 for the three month period.

If you’ve earned more profit than £150,000 over the three years you will not qualify.

But if you’ve earned a total of £150,000 or less averaged out over three years, you will qualify.

For example a profit of say £60,000 one year, £40,000 one year and £50,000 on another.

FAQ

Additional questions we’ve been asked and the answer we believe to be correct (details will be emerging over the next few days and we will update as necessary)

1. If I started my business since April 2019 and was about to submit a tax return for the first year trading, will I be eligible if I get my return in super quick?

Sadly no, as it stands (although we have seen a petition online so that might change, but I wouldn’t hold your breath)

2. If one year or more were over the 50k ceiling but the third was well under and overall I had an average of 50k or less (so a total of 150k or less) am I still eligible. ie does one year over 50k strike me out?

You are safe. It does not strike you out. It’s based on the average. We checked here on the government’s site

3. If my average earnings over 3 years were more than 150k can I get the grant?

Unfortunately not.

4. Does the grant have to be paid back?

No it doesn’t BUT an element of it will need to be put aside for tax purposes as it will be taxable.

5. What does it mean by taxable?

The money the self employed person gets will have to be taxed and declared on their tax return for the relevant return. The money the furloughed employee gets will also be taxed in the usual manner.

6. Can I continue my self employment and be eligible for the grant?

Yes you can (although furloughed employees who are at home and being paid their 80% are not able to continue working at all). So it’s different for self employed. You are allowed to carry on working.

7. I gather it will be paid in June but does that mean there’s nothing until then? how will I pay my bills?

It does mean you get nothing from that particular grant for a few months. The government are suggesting that we apply for Universal Credit and (Contributory) Employment and Support Allowance meanwhile. There are criteria for this and it’s all laid out here

However, your ‘bills’ should be entirely cut back. And ask for loans and mortgages to be put on hold for now. And no one is allowed to be evicted for three months for non payment of rent.

If you’ve got a vat bill coming up, you won’t need to pay that yet.

If you’ve got a payment on account for July, you won’t need to pay that in July either.

If you need to apply for a loan, please look up the CBILS Coronavirus business interruption loan scheme. It’s an interest free loan for twelve months, where the interest is paid by the government. There are qualifying criteria, no surprise there. More about this here

8. How do we apply for the grant?

HMRC will contact you and ask you to complete an form. They will write everyone a letter. DO NOT respond to an emails, texts, whatsapp messages etc purporting to be from the government. There’s scammers around. They’ve multiplied and are taking advantage of these strange times. If anything you receive asks you to input your bank details, do not do it. HMRC are taking this very seriously, they are warning people too.

9. I know this is not about being self employed technically but I am a director of a limited company, I am the sole director and often counted as being ‘self employed’. I pay myself the minimum via PAYE and then top up my earnings when I can with dividends (which I pay tax on). What will I get under this scheme?

Under this scheme you will get nothing as you are not actually self employed. You are technically PAYE and although your total income might be one figure, which includes dividends and perhaps rental income, the PAYE proportion is the figure which is going to be used. The only option at present is to furlough yourself and get a rebate from the government of 80% of your PAYE figure. Which will be based on the February salary.

10. Still about directorships – I am a sole director and my business has vanished almost overnight. I would like to furlough myself , is this possible?

Yes it is. Money Saving Expert’s Martin Lewis has confirmed that as long as the director does not actually work, they can keep the business going and meeting it’s filing obligations.

Please contact us, even if you are not our clients, on 01763 257882 or email david@theaccountancypractice.com and we will see if we can answer your questions. We won’t charge you! we don’t charge anyone for advice. That’s what we believe we’re here for. Straight talking, down to earth and friendly. That’s us!