16 things you need to know about new Government Jobs Support Scheme

Heralded with shock headlines of ‘we’ll be paying for this’ and talk of massive loans for the government to fund the support, you’d be forgiven for thinking that the government was announcing the second coming of Christ. (Other religions are available.) Indeed, initially, the headlines that there was a top up of 2/3 of salaries available, even if only a 1/3 of hours was worked seemed astonishingly great and …unbelievable. And as the saying goes, turns out it was ‘too good to be true’.

For underneath the hype, the fine detail gradually emerged during the afternoon and what we are left with is a very different picture. Don’t get us wrong, we think there has been an incredible amount of money put into the system by the government. We may have questions about HOW they have distributed the billions but you can’t deny there’s been a lot pumped into the bank accounts of many individuals and businesses.

So what are the new announcements, in plain English.

Let’s start with the replacement for the ‘furlough’ scheme. That is ending on Halloween as you’ll no doubt know. So what is happening from Nov 1st onwards?

The government are assuming that jobs will be lost because there’s not sufficient work/demand. They are aware that this might mean key staff with specific knowledge who are really important to your business may have their jobs on the line. So they want to ‘support’ the jobs to keep them open.

Jobs Support Scheme – the low down

- Eligibility: the employee must work at least a third of their usual hours in a ‘viable’ role (clarification coming on what viable actually means)

- The employee will need to have been on your payroll system by 23rd September to qualify

- You do not need to have used the furlough system to use this new scheme

- The scheme is designed to supplement a portion of the USUAL SALARY OF THE HOURS NOT WORKED.

- The employee is to receive at least 77% (figure of 78% used below on gov’t site – it’s just shy of 78% and they’ve rounded it up) of their usual income from 33% of their time spent in their usual role.

- For the time worked, employees must be paid their normal (pre covid) contracted wage (not the amount they were paid on furlough)

- The new scheme will run for six month from Nov til end of April 2021

- For every hour not worked by the employee, both the Government and employer will pay a third each of the usual hourly wage for that employee. The Government contribution will be capped at £697.92 a month.

- You will need to pay your staff and then apply for a reimbursement from HMRC.

- The hours your employees work can vary from month to month

- Employees can cycle on and off the scheme as the needs of your business dictate but each short-time working arrangement must cover a minimum period of seven days

- Employees cannot be put on redundancy or given notice while on the scheme

- Employers must agree the new short-time working arrangements with their staff, make any changes to the employment contract by agreement, and notify the employee in writing. This agreement must be made available to HMRC on request

- The employer will need to pay the national insurance and pension contribution as usual (but which was paid for by the government initially on the furlough scheme which is why we are clarifying this here)

- All small and medium sized employers are eligible for this scheme but large companies will have to fill in a financial check before they can apply

- If you’ve got your eye on the £1000 job retention scheme bonus (Feb next year) you will still be able to apply for this. IF THE EMPLOYEE HAS PREVIOUSLY BEEN ON FURLOUGH. Will post more info on this when details are published at the end of the month.

An example:

Someone working for 33% of their usual hours would get paid for those hours by the employer. However, the hours NOT WORKED would have a partial subsidy. A third from the employer and a third from the government.

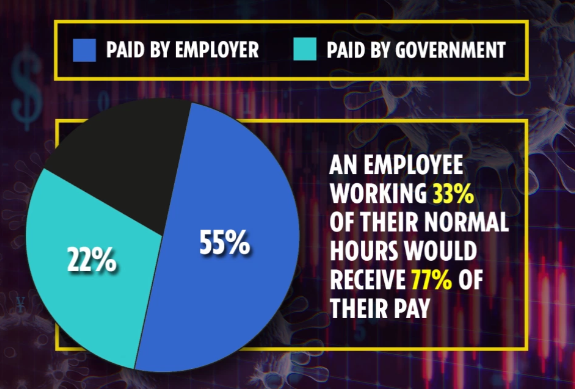

Here’s a nice graphic. So the employer would be paying the employee 55% for 33% of hours worked.

Yes you read that right.

This is how the figures above work:

An employee must work and be paid for a MINIMUM 1/3 (33%) normal hours.

For the normal hours that they aren’t working (in this instance 66%), the cost is split three ways

Govt pays 1/3 towards their wage (22%)

Employer pays 1/3 to their wage (22%)

Employee loses 1/3 (22%)

So employer pays 33% + 22% = 55%

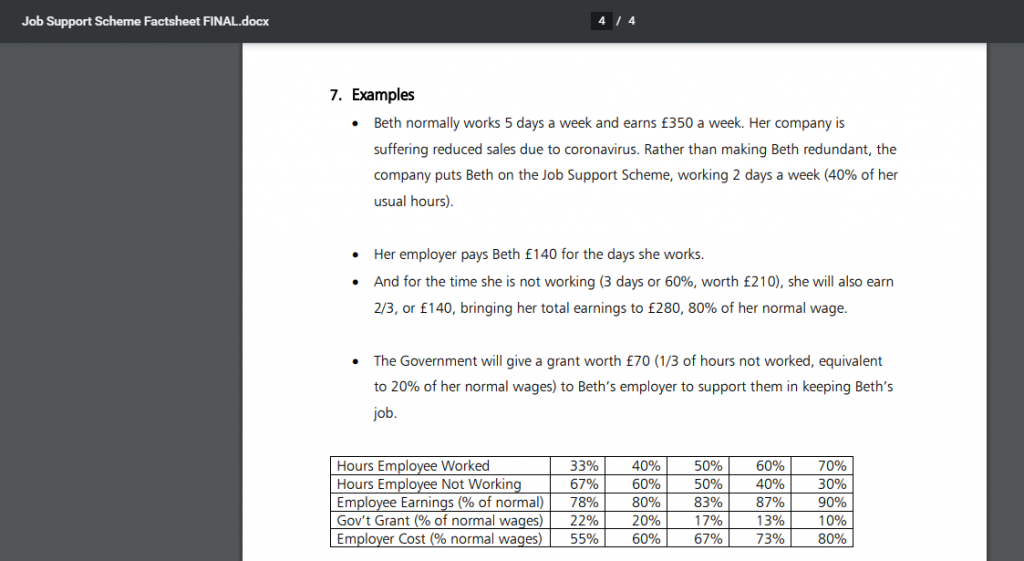

If your employee works more than 33% of their hours, here’s some examples of how the money works out. The support from the government reduces in terms of the actual amount of money, it’s on a sliding scale

We hope this has been helpful?

If you enjoy reading the official line from the government, please click here

As ever, please email info@theaccountancypractice.com or david@theaccountancypractice.com for more info. If you’d like to contact the author of this piece, please email me helen@theaccountancypractice.com, we’d be very happy to hear from you, client or not.

IF YOU’D LIKE TO READ MORE ABOUT THE OTHER ANNOUNCEMENTS PLEASE CLICK HERE