Coronavirus – How to access government support step by step

Welcome to this page which is our gateway to the various schemes currently on offer FOR BUSINESSES WHO ARE STRUGGLING DUE TO CORONAVIRUS.

We are very happy to help and advise clients as well as non clients. And we won’t charge for this advice. It’s something we can do to try to help in these terribly difficult times for us all.

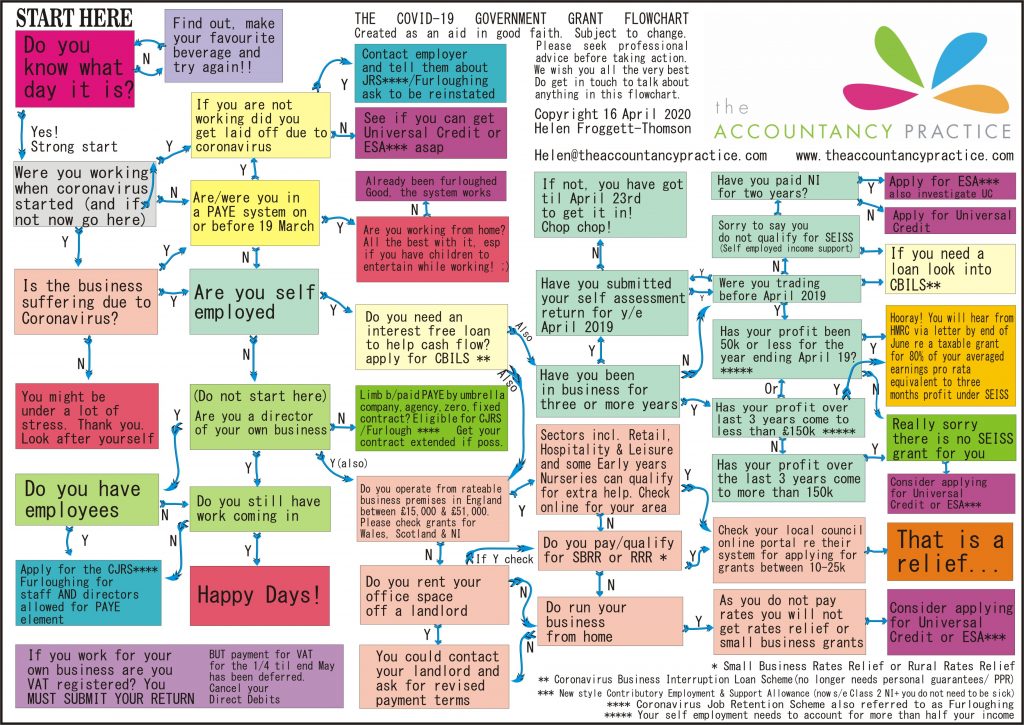

We’ve made a unique flowchart with the options being presented to adults & businesses of working age in the UK.

If you’d like to download the flowchart to enlarge it, please click here

Our innovative flowchart design has been endorsed by the respected accounting website Accountancy Web.

This should help you see what you are entitled to, in order to investigate below under the various headings.

If there’s an area you need to know more about, you will be able to read more if you click on the links.

If you have any questions after reading this, please email

helen@theaccountancypractice.com or info@theaccountancypractice.com

We’ve made a video up which explains the main scenarios. The only thing which has since changed is the cut off date for being enrolled on a PAYE system. It was 28th Feb but is now 19th March.

STOP PRESS – the end date for the furlough scheme has been extended from end of May to end of June

PAYE OR SELF EMPLOYED?

The main two strands of support centre around the mechanism by which you are paid.

All people paid using a PAYE system are supported by the

Furloughing/Job Retention Scheme

IF they were registered in a payroll scheme on 19th March 2020

All people who submit self assessment tax returns are eligible for SEISS

(Self employed income support scheme)

IF over half of their annual income comes from being self employed

IF their annual taxable profit falls below £50,000 for the year ending April 2019 (or averages out as under £150,000 over the last three tax returns)

IF they started their business before 6th April 2019.

The similarities between the two schemes:

Both offer 80% of the usual salary/profit for the month (with a cap of £2500 per monthly payout per employee on the furlough scheme and taxable profit under £50,000 a year for the self employed)

Both provide a taxable grant from the government which does not need to be paid back. You will pay tax on the money in the usual way for people who are furloughed and using the tax return system if you are self employed

Regardless of which scheme you are on, if you are struggling financially, because you don’t have enough money to live on, or because you fall outside the remit of one of the schemes, you can apply for Universal Credit if your savings (for yourself and any other adult with whom you are cohabiting) are below £16,000. The money you have set aside (if you’re self employed) for tax and national insurance does not have to count towards your savings. But you will need to tell the Job Centre about it in your telephone interview.

If you qualify for Universal Credit support the money you receive from the government (via either scheme) will be taken into account. It does not disqualify you for receiving other forms of help which are on offer.

Both schemes are running until the end of May as it stands presently. This may get extended.

**NEWS JUST IN (17th April) the furlough scheme has been extended til the end of June**

Click here to find out more about how to apply for Universal Credit

The main difference:

If you are furloughed from your job, you are not allowed to work for that business while you are furloughed (but you can work for another company). If you usually work for more than one company a month on PAYE you can be furloughed on all of them up to a maximum of £2500 payout per month (pre tax).

If you are eligible for the Self employed scheme you are allowed to continue working while you receive the support.

GLOSSARY

Click here if you’d like to read our article outlining the key words relating to the various new schemes (to bring you up to speed!)

MENU

CORONAVIRUS JOB RETENTION SCHEME/ FURLOUGH (CJRS). How to apply, even if you are not a client of ours, and who is eligible and how elements like zero hours, contracts, director pay, agency staff, variable hours work.

Click here to read more about the Furlough/Job Retention Scheme detail.

SELF EMPLOYED SCHEME (SEISS). How to apply, who is eligible, when the money will become available and how much you are likely to be given.

Click here to read more about SEISS.

GRANTS for small businesses from the local authority between £10,000 and £25,000.

- If you are in the Retail, Hospitality or Leisure industry and have property with a rateable value of between £15,000 and £51,000 you should be eligible for a cash grant from your local council for £25,000.

- If you have or are eligible for Small Business Rates Relief or Rural Rates Relief, and are paying the rates and the bill is in your name, you should be eligible for £10,000 payout.

- There are some rates holidays and suspensions available too. Please check with your local council.

- Please find the website for your local council to check the procedure they are using for handing out the money.

Click here to read the government guidance on these two grant schemes

OTHER SUPPORT for small businesses

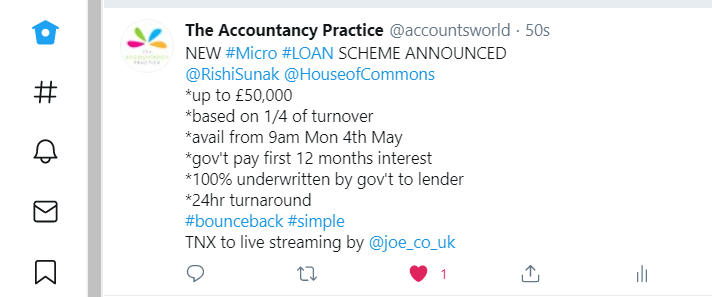

NEW ‘BOUNCE BACK’ LOAN SCHEME ANNOUNCED 27th April

Please click here for more information about the ‘bounce back’ loans

VAT. You are being advised to keep on submitting your vat returns but you don’t need to pay the current bills til the end of the tax year (End of March 2021). Please make sure you cancel your direct debits! Click here for more information

TIME TO PAY. You can ask HMRC to defer or delay your various payments. Click here to find out more.

CBILS (coronavirus business interruption loan scheme). Need a loan to tide you over? After considerable criticism for being difficult to access for small businesses, this scheme has adjusted some of the eligibility criteria. So even if you were turned down before because you didn’t have enough security, please apply again now.

- It’s an interest free (for 12 months) loan which is underwritten by the government to the lender (your business is still liable for the repayments)

- For amounts up to 5 million

- For businesses with a turnover of up to £45 million

- For borrowings £250,000 and under they no longer require your home as security and ‘lack of security’ is no longer a barrier to gaining the funds.

- If you business was deemed viable before this started and you intend to keep the business going, you should be eligible.

Click here to read more about CBILS

There is also a programme for larger businesses CLBILS launching at the end of April. Find out about CLBILS here.

Universal Credit. If you are struggling financially, because you don’t have enough money to live on, or because you fall outside the remit of one of the schemes, you can apply for Universal Credit if your savings (for yourself and any other adult with whom you are cohabiting) are below £16,000.

Here’s a step-by-step-guide-to-making-and-maintaining-a-universal-credit-claim

WANT TO READ THE GOVERNMENT DOCUMENT FOR ANY CLARIFICATION YOU MIGHT NEED?

If you would like to read the government document which also includes information on SSP and furlough for people self isolating and a number of other variables, please click here

If you would like to visit our website home page, please click here

If you have any questions about any of this, if you’re a client or not, please get in touch

Helen@theaccountancypractice.com or info@theaccountancypractice.com

If you would like to be kept up to date via our newsletter, please click here