Stronger together – Hold on!

NEW SMALL LOAN SCHEME ANNOUNCED 27th April

Here’s the official line from the government. We will update the ‘how to apply’ detail as soon as it emerges

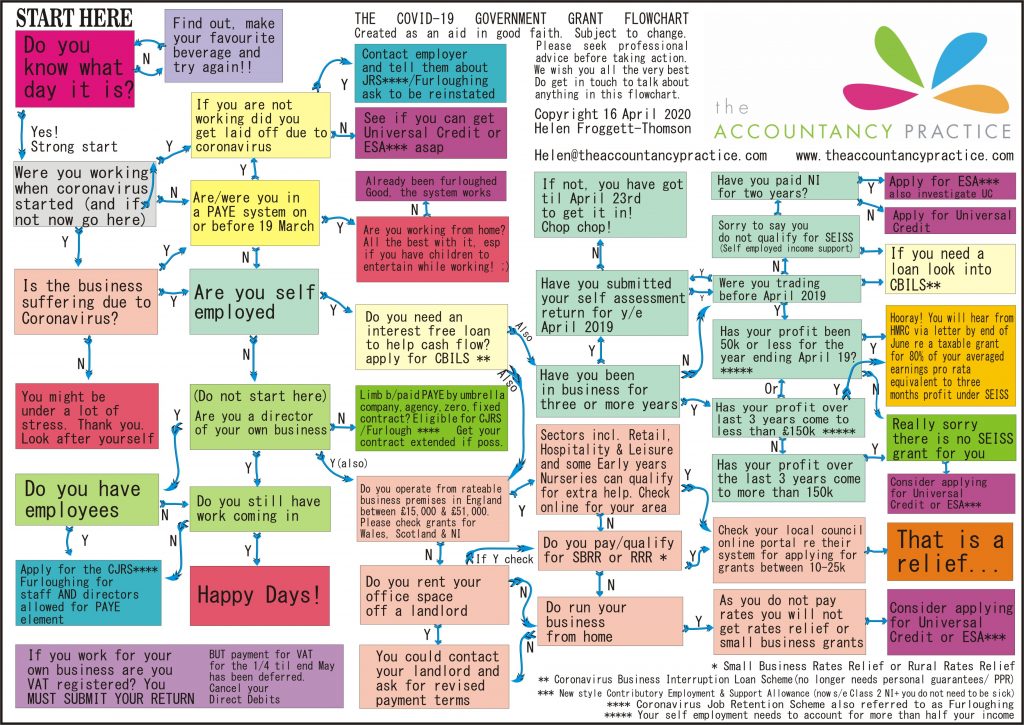

Let’s discuss practical things to help your business today! UPDATED 16th APRIL 2020

UPDATE (16th April). Latest measures

ALL BUSINESSES WHO OPERATE A PAYE SYSTEM CAN APPLY FOR GRANTS FROM THE GOVERNMENT TO SUPPORT SALARIES FOR THREE MONTHS.

It’s referred to as ‘Furloughing’ staff.

They are also calling it the ‘Coronavirus Job Retention Scheme or ‘CJRS’

It applies to anyone who is paid using the PAYE scheme and who was registered as being part of a scheme on 19th March 2020.

In an effort to encourage employers not to lay off staff, even if they can’t work from home and are effectively being paid to doing nothing (and indeed you are not allowed to work for the company who are furloughing you), the government is giving out a grant (free money no strings) to businesses to cover a significant portion of all PAYE employees salaries, for three months (at least).

There is a cap on this but it’s a generous one – the government will pay up to 80% of salaries up to a maximum payout of £2500 per month.

So this will be most beneficial for people with a salary just over the £30,000 mark. If a salary is above that figure, the employee will still only be entitled to £2,500. But this is a very real and significant boost for businesses and we hope this means that they will still continue to use self employed businesses where it’s possible to work remotely, so there’s a positive knock on effect.

This also includes Directors of small businesses or ‘one (wo)man bands’ where there’s a sole director.

It’s the PAYE element of your salary which is used. Any dividend payment you use to top up your income is not eligible and cannot be counted unfortunately. You can furlough yourself but you are not allowed to work for your company, other than essential statutory filings to HMRC. You can work for someone else though. And you COULD furlough yourself for three weeks, have a couple of days doing some work if it’s come in, and then re furlough yourself for a further three weeks.

VAT payments – further developments mean that VAT payments due between now and June can be deferred to release cash back into companies. The relevant amount will need to be paid by the end of the 20/21 tax year.

You don’t have to apply to defer your VAT it’s automatic for everyone, BUT YOU DO NEED TO SUBMIT YOUR VAT RETURN AS NORMAL.

SELF EMPLOYED – THE SELF EMPLOYED INCOME SUPPORT SCHEME (SEISS)

The government will pay 80% of profits using the self assessment tax return declared for year end April 2019. Businesses who have made over £50,000 taxable profit or those who started since 6th April 2019 do not qualify.

Click here to read more detail about the support packages

Universal Credit. The self employed have also been told that if they apply for Universal Credit, or the ‘new style’ Employment and Support Allowance (ESA) they do not have to comply with the ‘minimum income floor’ to qualify.

ESA however is an individual benefit and at present requires you to have worked for two years and paying national insurance. There is no savings limit and you can still apply if your other half is working.

If you qualify, you will be able to apply for, with almost immediate effect, £74 per week which is the same as someone on Statutory Sick Pay who is employed. But you don’t have to be ill to apply.

You need to have savings of less than £16,000 in the household to be eligible for Universal Credit. If you have saved money for your tax and national insurance, you need to declare this figure but it won’t get included in your ‘savings’ calculation. If you qualify the figure has recently increased to £94 a week. And could be more than that if you need housing, disability or childcaring support.

Please click here for information on these schemes

Click here for information regarding the support for the Self Employed

ALSO it appears that the government have pledged that no one can be evicted during this time or have their utilities cut off – gas, water, electricity etc.

So, no detail about how that’s going to work but it is reassuring.

LOANS FOR BUSINESSES

Coronavirus Business Interruption Loan Scheme (CBILS) will be available from Monday (23rd) and has had it’s interest free period extended from six months interest free to twelve months.

Please click here to find out more about CBILS.

VERY IMPORTANT – WHEN YOU RING TO POSTPONE PAYMENTS WITH YOUR BANK, LEASE, BUILDING SOCIETY, RENT, MORTGAGE, LOANS, UTILITIES etc, THE WORDING YOU USE SEEMS TO BE CRITICAL.

They’ve all got systems in place but we’ve heard that (and we believe it) if you just say you’ve lost work, income, jobs, show cancellations, whatever, they can’t help you.

Once you say “I have no income due to the Coronavirus”, Coronavirus is the keyword they need to hear to be able to enact their new policies, defer payments, halt late fees, etc.

And, apparently, they can’t coach you to say it. You have to do it yourself. Good luck. It’s a must do. If you want to talk to us about it, give us a call on 01763 257882

SECOND THING YOU NEED TO KNOW – THERE’S SCAMS GOING AROUND

like we needed that eh!?

‘IF IN DOUBT DON’T’

If anything requires you to insert your payment details etc to receive a rebate to do with Corona virus (obviously a clever ploy) please delete, spam it or report it on your local fb forum to help others. They are very convincing. And it’s disgusting they are preying on us all at this terrible time.

We really do need to pull together.

REASSURANCE REGARDING YOUR COMMERCIAL PREMISES IF YOU RENT

We recommend you contact your landlord and approach this directly and come to an arrangement, as indeed we have with ours. We recommend doing this so you have a respectful relationship with them for when this is over!

There’s a big Coronovirus Bill going through the House of Commons at the moment, which will covering loads of things including Self Employed. But also, this directly relates to businesses:

Extra protection for businesses with ban on evictions for commercial tenants who miss rent payments

Commercial tenants who cannot pay their rent because of coronavirus will be protected from eviction.

The Chancellor of the Exchequer, Rishi Sunak MP, said:

We are taking unprecedented action and doing so at unprecedented speed, because we know that businesses and their employees need help now.

That is why we are taking steps to change the law so that no company can be forced out of its premises due to loss of income. Alongside our support for workers and £330 billion of business loans and guarantees, this will help make a real difference to firms across the country trying to protect jobs.

Accountants help you look after your finances so we’re perfectly positioned to help you and provide a sounding board when the going gets tough. And it doesn’t get much tougher than this. Even if we’re not your accountant, we would be very happy to hear from you if you’d like someone to talk to. 01763 257882.

If you’d like to read about the new position re Lockdown, we’ve put it in plain english, please click here

If you’d like to read about the current support for self employed and employees, please click here

JUST ANNOUNCED (18th March) : There’s been some encouraging news about aid. British Business Bank have just announced some more information about how the loans will work for the Coronavirus Business Interruption Loan Scheme (CBILS) -and it should be available by Monday 23rd March. Click here to read more

However, we all need to help each other to keep going so there’s businesses to resume at full capacity when this is over. Values such as kindness and compassion have never been more important in business.

1. Let’s talk. Please ring us if you’d like to talk through anything. Early contact with HMRC to delay payments is advised for everyone. Let us know if you would like us to do this for you. If you’ve not paid your most recent tax bill we might be able to apply for extra Time To Pay. More details of the expected scheme can be found here.

2. Help from the government. Additional schemes offered by HMRC refer to these measures

- The government’s £330bn “Whatever it takes” response to the economic impact of coronavirus has included a 12-month delay to the IR35 off-payroll rules for private sector engagers. Which will be one thing less to worry about for anyone who has limited company or self employed contracts

- a statutory sick pay relief package for SMEs – for businesses with fewer than 250 employees, the cost of providing 14 days of Statutory Sick Pay per employee will be refunded by the government in full. This will provide 2 million businesses with up to £2 billion to cover the costs of large-scale sick leave

- Business Rate Relief for small businesses in the retail, hospitality and leisure industry for twelve months. The government is introducing a business rates holiday for retail, hospitality and leisure businesses in England for the 2020 to 2021 tax year.

- A £25,000 grant will also be provided to retail, hospitality and leisure businesses operating from smaller premises, with a rateable value between £15,000 and £51,000.

- Small business grants of up to £10,000 for all business in receipt of Small Business Rates Relief (SBRR) and Rural Rates Relief will be contacted by their local authority – they do not need to apply. The funding will be provided to local authorities in early April. Guidance for local authorities on the scheme will be provided shortly.

- The Coronavirus Business Interruption Loan Scheme to support long-term viable businesses who may need to respond to cash-flow pressures by seeking additional finance-this scheme, delivered by the British Business Bank, will enable businesses to apply for a loan of up to £5 million, with the government covering up to 80% of any losses with no fees. Businesses can access the first 6 months of that finance interest free, as government will cover the first 6 months of interest payments. Click here for the latest info.

- The HMRC Time To Pay Scheme. We can apply on your behalf to extend your payment terms. A dedicated helpline has been set up to help businesses and self-employed individuals in financial distress and with outstanding tax liabilities receive support with their tax affairs. Through this, businesses may be able to agree a bespoke Time to Pay arrangement. If you are concerned about being able to pay your tax due to COVID-19, call HMRC’s dedicated helpline on 0800 0159 559 or get in touch and we can do it for you.

3. Help from the banks and mortgage lenders. There’s a move afoot for mortgage payment holidays and this seems to be three months for all mortgage holders and grant and loan support for small businesses. Please click here for more information

4. Take proactive action now. While crisis usually means putting off things even further, in the case of your accounts, if you’re not already on XERO, now is the time to transition. The sooner we can see a clear view of your current position, the sooner we can help you sort this out and the easier it will be to assess what your tax payments should be, so we’re talking from a position of information not speculation

5. Cash is King. We’ve all heard this before but never before has this been more true. You need to ring fence as much as possible. The normal payment terms are no longer quite as relevant as they were and you need to work out how long your cash reserves will last. If you’ve not already of course. What costs can you cut and where can you trim? Most businesses look at this regularly anyway, but you need to be more strict than ever before.

6. Capital expenditure. If however you’ve got a large stockpile of cash and were about to make a large capital purchase that you still feel you’re going to need, hang tight as there are likely to be deals to be had in a few months.

7. Need to borrow money? The temporary Coronavirus Business Interruption Loan Scheme, delivered by the British Business Bank, will launch in a matter of weeks to support businesses to access bank lending and overdrafts. The government will provide lenders with a guarantee of 80% on each loan (subject to a per-lender cap on claims) to give lenders further confidence in continuing to provide finance to SMEs. The government will not charge businesses or banks for this guarantee, and the Scheme will support loans of up to £1.2 million in value.

8. Considering remortgaging? it might be better to do this now as money will likely be ‘cheaper’ and interest rates have already gone down. You would be raising the finance against your previous years’ earnings (if the existing process remains in place) and so you’ll perhaps be in a stronger position using last year’s figures. If you wait, your ability to borrow against potentially reduced profit might make arranging a remortgage more difficult.

9. Insurance. Insurance policies are carefully worded to protect the insurance companies and not the business covered. We all know that. But there are certain factors which you need to bear in mind. Business Interruption Insurance is the element which relates to your business being compromised over a period but the key element which relates is the ‘notifiable diseases list’. HOWEVER according to the announcement made last night, uninsured retail, hospitality and leisure businesses will be eligible for up to £25,000 grants. We’ll have to see how that pans out.

10. What are your commitments? Have a close look at your suppliers and debtors. Contact everyone as soon as possible to agree modified payment terms if necessary, in order to keep everyone’s business in your chain ticking over. While the landscape is completely changing, business etiquette and attempts at fairness will be remembered. Let’s work together to do everything we can to be able to rise when the dust settles.

11. Be consistent. What’s your message to your circle of clients and suppliers? Bear in mind your social media and newsletter communications. Attempt to keep ‘on message’ and find an angle to inform if at all possible.

12. This too shall pass. We will all evolve. We are so sorry that we’re even having to write this list. It’s almost as if we’re living in a movie. We’ve been watching the news and you suddenly find yourself thinking ‘are we going to wake up soon’? This is very real but let’s do all we can to get through it together. We are reminded of our three values – Commitment, Compassion and Collaboration. They are even more relevant looking ahead. If you’d like to watch us giving some tips on using compassionate communication to handle conflict and how to achieve this, please click here. We are committed to helping you ride this out with us and want to collaborate where possible to make sure we can limit the fall out. Good luck to us all! We will keep you informed of any changes as they become evident.

Please email David@theaccountancypractice.com or call us on 01763 257882 if you’d like to have a chat about anything above.